Your 2021 Taxes—Edmonds CPA Hot Tips

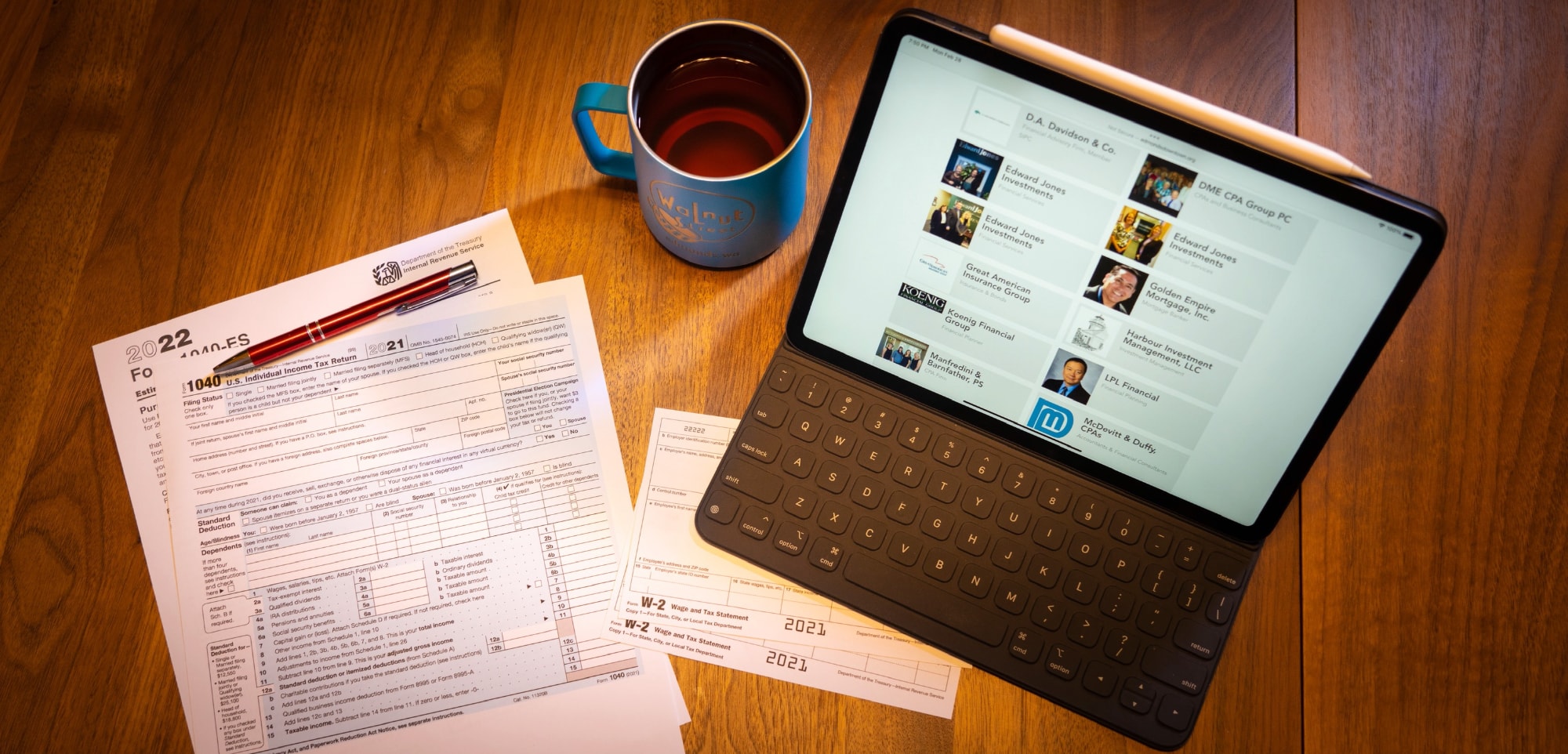

Tax season doesn’t have to be stressful, especially when you have a partner in the process! And, while many of us have been doing our taxes for years and feel somewhat knowledgeable, we realize there may be things we’re missing. So, we talked to two Edmonds CPAs—Nancy J. Ekrem, Managing Shareholder, DME CPA Group, and Nancy Duffy, Partner at McDevitt & Duffy CPAs PS—to get their hot tips on our 2021 taxes. What do we need to know? What are we missing? How do they feel about procrastinators? Let’s get into it.

2021 taxes—what’s different this year?

As you’re working on your taxes on your own or with an accountant, you may notice a few things that are different this year. If you have children, Nancy Ekrem notes you’ll want to be sure you’re claiming your Advance Child Tax Credit. Now, you may have been getting your direct deposits for that already, but some families will receive half of their credit when they file their 2021 taxes. Nancy Duffy adds, “if you received any advance child tax credit, the IRS sent out Letter 6419. Be sure to include this information on your tax return. If you don’t, you risk calculating a tax refund that is too big. And, eventually, the IRS’ computers will recalculate your tax return and find the error. Then you’ll get a letter from the IRS asking for the money back.”

Another credit noted by Nancy Duffy is that “All taxpayers who received the Third Economic Impact Payment should have received Letter 6475, which confirms the amount they received. The maximum amount received per person was $1,400. It is important to include this information in your tax calculations because if you didn’t get the stimulus payment or you didn’t get the full amount, you may get more money back on the recalculation. This is all good news.” There are also a whole host of other rules and credits you may be eligible for, depending on your situation.

Tip for a low-stress tax season

Nancy Ekrem puts it simply: “Start early and get help.” You don’t know what you don’t know and it’s your CPA’s job to be an expert in the numbers, rules, and write-offs potentially waiting for you. Don’t miss out by waiting too long! Plus, if you’re getting a refund, it’s always nice to file early since the IRS is slow to pay and quick to make a withdrawal.

As Nancy Duffy notes, reinforcing that we’re not crazy for feeling it, too: “Taxes just get more complicated. Congress has good intentions to ‘help’ out, but the ‘help’ is all calculated on your tax return. For example, we all need to now input how much we received for the Third Economic Impact Payments and Advance Child Tax Credit on our tax returns. If you don’t put these correctly on your tax return, the IRS computers won’t have a ‘match.’ The result of this error is a delay in getting your tax refund or an IRS white envelope letter asking you for some clarifications about your tax return. So, the tip? Use some kind of tax software or hire a CPA. I can’t imagine doing even the simplest tax return without a computer anymore.”

What are people missing out on by not hiring an accountant?

As Nany Ekrem says, “Experienced preparers can find opportunities to reduce your tax bite that you might not think of on your own.” For example, Ekrem was able to help one of her clients reduce their taxable income by $25,000 after discovering their QBI (Qualified Business Income) deductions were calculated incorrectly, saving $8,000 in tax!

Duffy agrees. “There are lots of good CPAs,” she says, “but the most important thing is finding someone you can really talk to. When you have an ongoing relationship over several years, a good CPA gets to know YOU. We prepare your taxes every year, but even more, we are here to help you with some of your biggest financial decisions: buying a house, retirement, receiving an inheritance, and cash counseling.”

Consider your situation

If you have a single employer and few investments, you may be fine filing your own taxes. If you have business income or rental properties, you’ll probably find that the expense of hiring an accountant is well worth your peace of mind and potential tax savings. And, if you don’t know, ask! It’s best to wait until they’re not deep into tax season, but many accountants would be happy to take a quick phone call to tell you about their services.

About the fee structure

As with many things, when you ask the “What does it cost?” question, the answer is often, “Well, it depends.” Each firm has a different payment structure (flat fee, percentage, hourly, subscription, etc.), however, pretty much all of them will meet with you to go over all of the details prior to your spending anything on accounting. Do you have more than one income stream? Do you own a business? Do you get a headache just thinking about your taxes? Do you love to delegate things outside of your expertise? You may be a fit for hiring a CPA. As Duffy says, hiring an accountant “may seem expensive, but do the math: If you spend $350 at HR Block, you may only spend an additional few hundred dollars at a CPA office where you can develop a relationship. In my opinion, that is money well spent.”

And, when your money is in the mix, handing it over to a person you care about in support of their business while they support your overall livelihood—that’s a double win.

By Whitney Popa, photos by Matt Hulbert